-

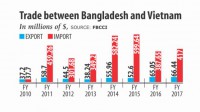

Bangladesh targets $1b trade ties with Vietnam

-

VIETNAM COFFEE EXPORTS UNDER THE TOP 2 OF THE WORLD

-

Rice Exports by Country

-

Relations between Bangladesh and Vietnam

-

Bangladesh Economic Outlook 2019: A resilient economy in need of sound policy LIGHTCASTLE ANALYTICS WING

-

Bangladesh Economy Continues Robust Growth with Rising Exports and Remittances

-

Vietnam beats us in RMG for last 5 months in 2019

-

Bangladesh to seek more Vietnamese investment

.jpg)

Investors have a number of options for entry into the Vietnamese market. In this chapter we

will outline the most common forms of corporate structure options for foreign investors.

Representative office

A Representative Office (RO) offers a low-cost entry for companies seeking to gain a better

understanding of the Vietnamese market. As such, this option is among the most common for

first-time entrants to the Vietnamese market and often precedes a larger presence within the

country. Currently, ROs are permitted to engage in the following activities:

• Conducting market research;

• Acting as a liaison office for its parent company; and

• Promoting the activities of its head office through meetings, and other activities, that leads

to business at later stages.

Vietnam’s Ministry of Planning and Investment (MPI) does not currently specify required capital

for ROs. While the MPI does not impose specified capital requirements, companies will be

required to show that their capital contributions are sufficient to fund the activities of their

operations. As a result, potential investors should prepare to commit a minimum of US$10,000

to fund their operations. ROs can be set up in between six to eight weeks.

Branch office

A Branch Office (BO) can conduct business activities in Vietnam with the parent company’s

business scope. To set up a BO, a parent company must have conducted business in its home

country for at least five years. BOs are limited to certain types of service businesses, such as

finance and banking. BOs can hire staff directly, make it easier to do contracts between parent

company and Vietnamese companies, and serve in similar ways to a liaison office. BOs are

permitted to engage in the following activities:

• Rent offices;

• Lease or purchase the equipment and facilities required for operations;

• Recruit local and foreign employees;

• Remit profits abroad;

• Purchase and sell goods and commercial activities per licensing; and

• Set up accounting, marketing, and HR departments to represent the parent company.

The BO will need to obtain an establishment license and have a seal with the name of the

parent company. The BO will also need to appoint a branch manager who is a Vietnam resident

Foreign companies may appoint a manager from their countries of origin; however, this employee

must get a Vietnam work permit to be hired as a BO manager.

The Department of Industry and Trade approves the registration of the BO after the company

submits all the documents with the process taking 20 working days.

100 percent foreign owned enterprise

A 100 percent Foreign Owned Enterprises (FOE) in Vietnam can operate under the following

structure:

• Joint stock companies; and

• Limited Liability companies.

Limited liability Companies (LLC) are the most common form of investment for foreign investors

due to their reduced liability and capital requirements.

LLCs can be broken down into single member LLCs, where there will only be one owner, and

multiple member LLCs, where there will be more than one stakeholder. These owners can be

private individuals or companies, depending on the requirements of a given investor.

The setup time for a 100 percent FOE ranges between two to four months on average.

Joint venture

A joint venture (JV) entails the partnership of companies or individuals for a specific business

purpose. JVs are not a unique corporate structuring option; partners usually establish an LLC

for standard JVs and a Joint Stock Company (JSC) if there is a desire to list on Vietnam’s

stock exchanges.

For investors purchasing stakes in state owned enterprises equitized on Vietnam’s exchanges,

the JSC structure is required. When entering the Vietnamese market, foreign investors can

choose to enter into joint ventures as a majority (ownership more than 50 percent) or minority

(ownership less than 50 percent) stakeholder.

The capital requirements for JVs are the same as for 100 percent FOEs.

Unconditional sectors are not subject to specified capital requirements. However, Vietnam’s

MPI does apply industry specific capital requirements in many cases.

The percentage of ownership, and thus the amount of capital contributed, is the more important

metric to use when evaluating the capital requirements for JVs in Vietnam. At present, statutory

guidelines impose a foreign contribution floor of 30 percent for JVs, as well as a ceiling in

specific conditional sectors. The government also mandates minimum contributions for domestic

investors on an industry specific basis. Set ups for JV take about two to four months.

Public private partnership

A Public Private Partnership (PPPs) entails a partnership between a foreign or domestic

enterprise and the government for the completion of key infrastructure projects. Vietnamese

authorities are aggressively pursuing PPPs for a variety of infrastructure projects as a means of

filling gaps left by a reduced role of state-owned enterprise, rising population, and increasing

urbanization.

The five types of PPPs are Build-Transfer-Operate (BTO), Build Transfer (BT), Build- OperateTransfer (BOT), Build-Own-Operate (BOO) and Build, Transfer and Lease (BTL).

|

|

FIE Structure Type |

Common Purpose |

Pros |

Cons |

|

1 |

Representative |

- Non-separate legal entity |

Easy registration procedure |

- Cannot conduct profit making |

|

2 |

Branch Office |

- Non-separate legal entity |

Can remit profits abroad |

- Limited to certain industry sectors |

|

3 |

Limited Liability |

Separate legal entity |

- Liability limited to capital contribution |

- Cannot issue shares |

|

4 |

Joint-Stock |

Separate legal entity |

- Liability limited to capital contribution |

- Three of more shareholders requires |

|

5 |

Joint Venture |

Partnership of companies or individuals for specific business purpose |

Unconditional sectors not subject |

- Minimum contribution guidelines for domestic investors for industry specific cases |

|

6 |

Public Private |

Entails partnership between foreign or domestic enterprise and government for infrastructure projects |

Government aggressively pursuing |

- Several PPP models |

Copyrights Thiet Ke Website by ungdungviet.vn