-

Bangladesh targets $1b trade ties with Vietnam

-

VIETNAM COFFEE EXPORTS UNDER THE TOP 2 OF THE WORLD

-

Rice Exports by Country

-

Relations between Bangladesh and Vietnam

-

Bangladesh Economic Outlook 2019: A resilient economy in need of sound policy LIGHTCASTLE ANALYTICS WING

-

Bangladesh Economy Continues Robust Growth with Rising Exports and Remittances

-

Vietnam beats us in RMG for last 5 months in 2019

-

Bangladesh to seek more Vietnamese investment

2020 is going to be a crucial year for the Bangladesh garments and textile industry. As the industry is going through a transformation phase some major organizational changes are on the card in the upcoming days. Starting in the late 1970s, expanding heavily in the 1980s and finally booming in the 1990s, Ready Made Garments industry has created a success story for Bangladesh. Turning up as a gigantic industry within a short span of time, RMG sector has become the backbone to the economy of the country as the largest source of export earnings (84%) and employment (20 million). Bangladesh RMG sector has a goal to achieve 50 Billion export targets by year 2021 that will cover 8-10% of total apparel export of the world market. Currently the country holds approximately, 7% of that with 34-billion-dollar export. However, at current growth pace the target is not possible to achieve. This article tries to put light on the current scenario of the garments and textile industry of Bangladesh and portray the outlook in 2020.

Sector Profile Analysis

The last FY can be characterized by negative to sluggish growth of exports. In fact, first time in the history export growth registered negative growth for four consecutive months on the trot. In December, 19 the growth raised its nose up but very slightly unlike the previous years. However, according to World Bank and other economic models Bangladesh is forecasted to sustain in 2020 and the garments exports are also forecasted to grow positively.

| Table-1: Sector Profile, Garments and Textiles, Bangladesh, 2018-19 FY | |

| No. of export oriented garments industries | 4621 |

| Total garments export | 34.13 billion $ |

| % of total exports | 84.21% |

| Labor force | 4 million |

| % contribution to GDP | 11.17% |

| % of value addition | 63.23% |

| Major products | T-shirts, polo shirts, jerseys, pull overs, trousers |

| Major markets | EU, USA, Canada |

| No of textile units |

Yarn Manufacturing – 425

Fabric Manufacturing – 796 Dyeing-printing-finishing – 240 |

| Investment in primary textile sector | Over 6 billion $ |

| Exports of textiles | 229 million $ (April-Sept, 2019) |

| Exports of jute goods | 333 million $ (April-Sept, 2019) |

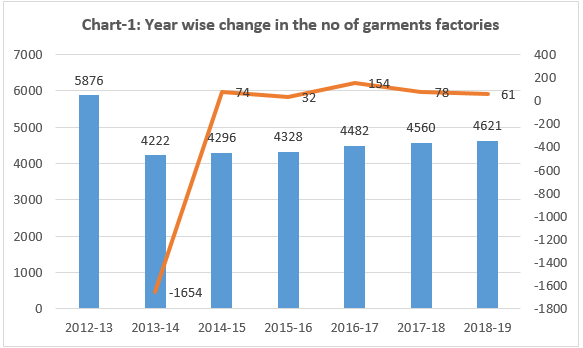

The sector profile shows that the total no. of garments factories registered under BGMEA is 4621 now. If we analyze the trend of change in the no of factories from chart-1, the number of new factories being added every year is decreasing. There was a big drop in the number of industries in 2013-14 when accord and alliance came in to action. After that every year the on average around 75 new industries being added in total. Furthermore, we have seen that around 200 industries has been shut down in the recent times which indicated the newly added industries fully compliance and they are here to stay. So, though the number of new industries every year is decreasing but the quality of the newly launched industries are far better taking Bangladesh in the next level as a role model of green industries and sustainable practices. Overall, the total number of LEED-certified garment factories in Bangladesh is 90 now, including the 24 platinum rated buildings, according to the USGBC. Although the buyers are not paying any extra money for green buildings, such initiative still helps a lot in branding and it is necessary for our own survival.

Another important thing to notice is the number of workers being stagnant at 4 million for a few years now working directly in garments industries according to BGMEA. It indicates that the total number of workers per production unit is not increasing rather may be in the decreasing side. One explanation can be adoption of some semi-automatic processes in the production line resulting in less manpower requirement. Overall, this is not a bad thing for the industry and also the workers as they are being paid six times more than a decade before.

Another major thing to look for is the value addition. Value addition is increasing day by day as industries are becoming more self-sufficient in backward linkage industries specially in knit sector. in woven sector the industry is still dependent on foreign sources for fabrics which reduces the value addition scopes. Matter of hope is that the denim sector is rising heavily of late. According to major denim manufacturers of the country, they used to produce denim trousers for $5.50 and $7.0 a piece earlier, but now the price range has gone up to $10 to $11. Bangladesh exports denim goods worth more than $3 billion a year and has already overtaken China to become the top denim supplier to the EU. The production capacity of the 31 denim mills in Bangladesh is more than 40 million yards a month against a demand for nearly 70 million yards. The rest of the demand is met through imports from countries like China, India, Pakistan, and Turkey. According to manufacturers, new technologies used in washing and polishing as well as the increasing use of finer fabrics and design are allowing Bangladesh to add more value to denim items.

Analysis of the table-2 depicts cluster based product’s export growth this year. It can be seen that both in knit and woven segment articles made from made-made and synthetic fibre have registered huge growth. Woman’s or girls’ anoraks, wind-cheaters, etc. of man-made fibers recorded the highest growth of 44%. Even in the knit segment products like jerseys and pullovers made of man-made fibers are the top with 29.25% growth. In contrast, some cotton based articles registered very low growth. Specially men’s and women’s trousers, blouses and pullovers made from cotton and other materials (than man-made and synthetic) has recorded negative growth. This analysis clearly indicates buyers’ transformation from cotton based to non-cotton based products in the recent past. And it can be surely forecasted that the trend will be the same in the upcoming years. One big reason may be the innovations in man-made and synthetic fibres and products; today non-cotton products are as much (or in some cases more) comfortable as cotton based products. Also today consumers are more aware about the hazardous environmental impacts of cotton cultivation. Another negative point about the synthetic products was concerned with its non-biodegradability. This is a crucial point in the future business decisions for the entrepreneurs as most of the back ward linkage industries are cotton based. So, if the trend continuous we will be again dependent on foreign products and lose huge scope of value addition.

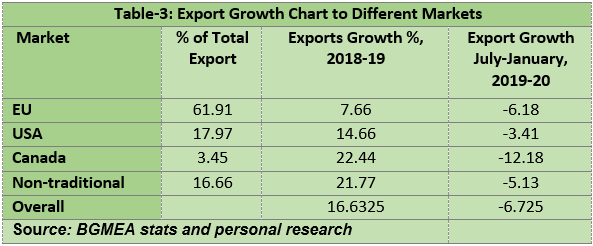

Analyzing further more from table-3, it can be seen that exports to the traditional market has been stable in the FY 2018-19 but in the last 6 months there is a negative growth. Canada and the non-traditional markets registered highest growth at 22.44% and 21.77% respectively in the last FY 2018-19. But even these markets recorded a negative growth in the last six months at -12.18% and -5.13% respectively. It will be very difficult to off-set this negative row may be due to the corona virus epidemic in China. Many export orders will be halted or delayed due to a seize in imports from China.

In the EU market Hungary, Cyprus, Portugal, Malta and Sweden registered highest growth, whereas the bigger markets like Germany, UKI, Spain, France and Italy registered very low growth. In the non-traditional market India, China, Japan, South Korea and South Africa recorded the highest growths. In this market segment only Turkey registered negative growth at -27.02% and another potential market for Bangladeshi apparel Russia registered 14.17% growth. so, overall indication from this analysis is that, more market innovation is required to sustain the export market as the regular markets like EU and USA are shrinking day by day mostly due to their near shoring and even on shoring business strategies taken off late.

Labor Force and Skill-base Analysis

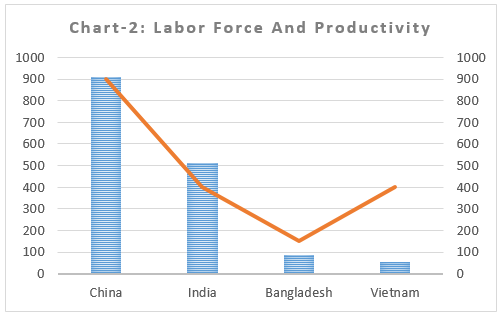

Human resource has been always vital issue in the continuous development of the textile and apparel sector. In the last decade the wage of the garments workers has been increased six folds. Furthermore, the business operation costs in last decade has also increased 35-40%. In contrast, according to different authentic sources, the average price from the buyers has been decreased by 3-4%. So allover we have lost 35-40% price competitiveness in the market. In this circumstances, the skill profile of the labor force has become a vital issue. The industry now cannot afford unskilled human force in the industries. However, in terms of labor wage Bangladesh is still a competitive place for the garments buyers (reference table-4).

Manufacturing garments is typically a low-skilled job, so garment importers might not be particularly concerned about whether a workforce is skilled. However, skilled labor is becoming more important as production operations are demanding better performances. Specially in the managerial positions proper skill increases the efficiency and productivity of a factory, which shortens the lead time. So when productivity and the quality of education is coupled with wage Bangladesh tends to lag behind the competitors as the education and training infrastructure is still in the primary levels (reference chart-2).

One research project has been taken by the ministry of textiles and jute, government of Bangladesh to forecast the need of textile and garments professionals in the upcoming years in the Bangladesh market. They have depicted that the industry will need around 25000 professionals in the upcoming years but there was no study on what are the core skills that the professionals have to acquire to sustain the labor market. So, it is a high time for our country to heavily invest in skill development by designing appropriate training and education programs throughout the institutions.

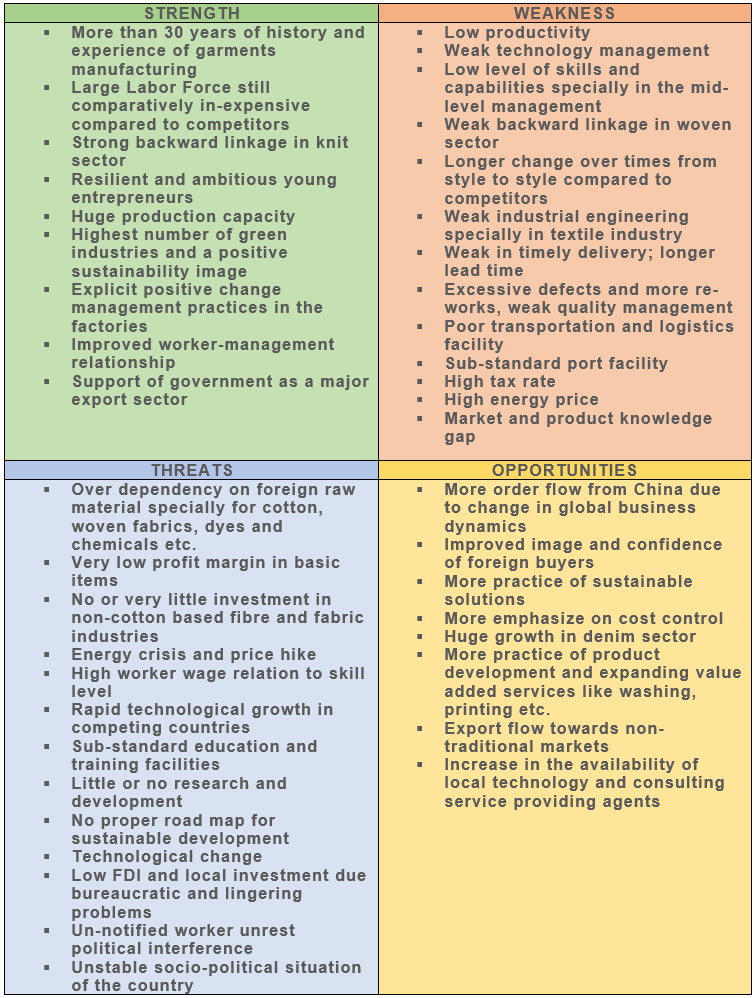

SWOT

From the above mentioned analysis and Textile Focus research a SWOT analysis of the Bangladesh textile and garments industry for the year 2020 and onward is outlined below.

Conclusion

Bangladesh textile and apparel industry is standing at a cross road facing difficult challenges. But this is also true that opportunity resides at the opposite of the challenges. It’s a high time for the industry take appropriate steps to step over the hurdles and avail the opportunities in offering in plenty in the global market. Still Bangladesh is regarded as one of the best choices for most of the buyers as safe and secure source of ready made garments. And as our capability of designing and product development improves industry will start making more value added products, the trend of which is already evident. Today Bangladesh is the home of highest number of green factories which adds to our positive image as a sustainable partner of global business. And most importantly, non-compliance factories are gradually pushed out of the market which is also a good sign in the longer run. We need better factories, not a lot of factories. This comprehensive study of the review and outlook has been aimed to help our valued readers to have a proper glimpse of the industry conveniently so that it helps them visualizing their future plans. Textile Focus team hopes for the best and continues to work as a sustainable development partner of the garments and textile industry hand to hand.

Copyrights Thiet Ke Website by ungdungviet.vn