-

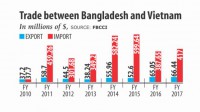

Bangladesh targets $1b trade ties with Vietnam

-

VIETNAM COFFEE EXPORTS UNDER THE TOP 2 OF THE WORLD

-

Rice Exports by Country

-

Relations between Bangladesh and Vietnam

-

Bangladesh Economic Outlook 2019: A resilient economy in need of sound policy LIGHTCASTLE ANALYTICS WING

-

Bangladesh Economy Continues Robust Growth with Rising Exports and Remittances

-

Vietnam beats us in RMG for last 5 months in 2019

-

Bangladesh to seek more Vietnamese investment

Bangladesh Economic Outlook 2019: A resilient economy in need of sound policy

LIGHTCASTLE ANALYTICS WING

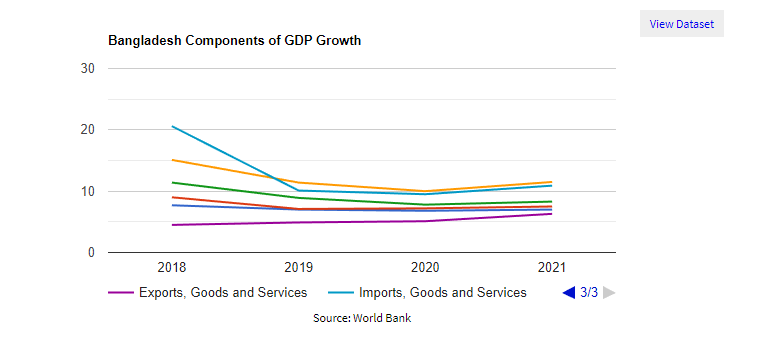

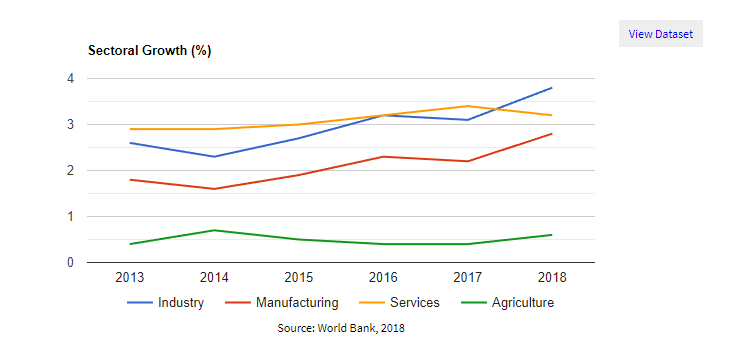

Driven by strong private consumption, public investment and remittance inflows, Bangladesh’s economy expanded by a remarkable 7.86% to USD 275.8 billion in 2018 , recording the highest growth rate in the country’s history. 2018 marked a 5-year run of continuous increase in the country’s GDP growth rate, a trend that is also forecasted to continue (LankaBangla Asset Management, 2019). One of the most densely populated economies in the world, Bangladesh has continued making impressive strides in achieving social development goals for its 167 million citizens. The resilience of the country’s economy is commendable. However, sound economic policy must be implemented to mitigate underperformance of the financial sector, diversify exports and create better employment opportunities by increasing private investment.

Drivers of Robust Growth

Manufacturing and construction sectors were the main propellers of economic growth in FY 2018.

Ready-made garment (RMG) exports, which accounted for 83.4% of total exports, increased by 8.8% in terms of nominal dollars. Even though the 5.3% growth rate of export earnings did not meet the forecasted target of 8.2%, the growth of the RMG industry exceeded the annual target of 7.1%. However, the growth in the RMG sector is dominated by a few selected products and Bangladesh could easily take advantage of the expanding global apparel demand by diversifying the RMG export basket.

Given the country’s sustained economic growth and the evolving dynamics of global trade, Bangladesh must make a diligent attempt to expand its export profile beyond RMG products. Exports of non-RMG products declined by 9.5%, dragging down the total export growth rate. In FY 2018, growth of exports to the traditional markets have out-performed exports to the non-traditional market.

.png)

Bangladesh is on track to graduate from Least Development Country (LDC) status in 2024 and till 2027, it will get the Everything But Arms (EBA) benefits in the EU markets. After 2027, the Duty Free-Quota Free market access and the relaxed rules of origin (RoO) benefits for LDCs are likely to end, adding to the global trade challenges Bangladesh might face soon. Rising cost of labor and strict enforcement of safety standards in RMG manufacturing will increase cost of production, threatening the price competitiveness of the country’s RMG exports in the global market. Therefore, Bangladesh must devote resources to the development and production of non-RMG products, such as leather, which may have a promising future in the global market.

Like RMG exports, remittance flows increased by 17% to reach USD 14.9 billion, equivalent to about 5.4% of the GDP. About 56% of the remittance earnings came from the Gulf countries. Growth of out-migration to Saudi Arabia reduced to only 1.2% in the FY 2018 as the Saudi government stopped recruitment of foreign workers in 12 job categories in which majority of Bangladeshi low-skilled migrant workers were employed. Driven by strong manufacturing growth and remittance inflows, the construction industry grew by an estimated 9.9%.

Agricultural growth was limited in early 2018 due to excess flooding, although harvests recovered afterwards. Low food production and weak management of resources from FY 2017 caused food inflation to spike to 7.1% in early 2018. Headline inflation, which stands at 5.8%, was moderated by low levels of non-food inflation. A fall in rice prices, propelled by excellent boro harvests, rice and wheat imports, eased food inflation to about 6% late 2018. Strong remittance inflows, domestic demand and the depreciating exchange rate helped contain non-food inflation rates.

Public and private investment were important contributors to the high GDP growth rate in 2018. Real investments increased by 10.5% compared to FY 2017. Public investment to GDP ratio increased while private investment to GDP ratio decreased. However, Foreign Direct Investment (FDI) declined to USD 1.58 billion in FY 2018 from 1.65 billion in FY 2017. Bangladesh leaped up 7 places in the Global Competitiveness Index from 2017, but it ranked the lowest amongst its East and South Asian neighbors in Ease of Doing Business Ranking 2018. The country’s Logistics Performance Index has dropped over the last two years, signaling a significant concern for local and foreign investors.

Critical challenges require attention of policy makers

Bangladesh needs to form a stable macro-economic framework by addressing the problematic areas of exchange-rate volatility, poor banking and fiscal management. The overall budget deficit increased due to a fiscal deficit worth 4.5% of GDP in FY 2018. A high financial account surplus has supported the current account deficit. The government remains committed to the 5% of GDP deficit target for FY 2019- 2021. Propelled by 25.2% growth in merchandize imports, the trade deficit rose to USD 18.3 billion from USD 9.5 billion. The services account deficit increased to USD 4.8 billion from USD 3.3 billion motivated by 21% growth in payments for transportation and 78% in other payments. Income account deficit also increased to USD 2.4 billion from USD 1.9 billion due to a 28.3% growth in income payments.

The taka-US Dollar rate and foreign currency reserves were strained by a rise in the current account deficit. The risk of bad debts continued to be low despite high fiscal deficit. During FY 2018, the taka-US dollar rate declined in both nominal and real terms. In the interbank market, the nominal exchange rate depreciated by 3.9%, and the Real Effective Exchange Rate (REER) declined by 2.7%. Bangladesh Bank (BB) sold over USD 2.3 billion as an act of intervention to adjust the exchange rate. However, Bangladesh Bank should allow more exchange rate flexibility in order to prevent further reserve depletion and to avoid the risk of a more volatile exchange market.

The performance of the banking sector continued to be a drag of the economy. The volume of non-performing loans (NPLs) rose to BDT 893.4 billion in the middle of FY 2018 from BDT 743 billion from the end of FY 2017. In comparison to mid-2017, total liquid assets of banks decreased by approximately 7% by mid-2018. The country needs to allocate more members of the judiciary system to solve the high number of NPLs cases.

The Road Ahead

Once dubbed “basket case” because of extreme poverty following the Liberation War in 1971, Bangladesh has achieved global recognition for making exceptional progress in human development (Economist, 2012). According to the Human Development Report 2018, Bangladesh is ranked 136 out of 189 countries and territories with a Human Development Index (HDI) value for 2017 of 0.608 which puts the country in the medium human development category. Over the last 27 years, the HDI value of Bangladesh increased by 57.1% and GNI per capita increased by 178.6%. Meanwhile, Bangladesh’s life expectancy at birth improved by 14.4 years, mean years of schooling increased by 3 years and expected years of schooling has also advanced by 5.8 years. The arrival of Rohingya refugees, however, will test the resilience of the country’s economy and its ability to maintain the social development momentum while providing humanitarian support.

The country has made excellent progress in expanding electricity supply, but further steps need to be taken to satisfy the demand for electricity which is rapidly increasing with the growing economy. In order to strengthen the financial position and distribution of utilities and ensure more efficient consumption, a cost-based pricing mechanism could be adapted. Bangladesh could also invest on cross-border transmission interconnections to increase electricity supply in a cost-effective method.

Bangladesh has been forecasted to continue its impressive economic performance and social development in the short run. As the country continues its remarkable progress, policymakers should focus on a few key areas of improvement including a stable macroeconomic structure, an efficient financial sector and a dynamic electricity market. Employment opportunities for the young population should be taken into consideration while making investment decisions. These measures will ensure fairer distribution of the benefits of robust growth.

Authors: Farah Hamud Khan, Business Consultant and Dipa Sultana, Senior Associate, LightCastle Partners

- - Bangladesh targets $1b trade ties with Vietnam

- - Bangladesh to seek more Vietnamese investment

- - Relations between Bangladesh and Vietnam

- - Bangladesh Economy Continues Robust Growth with Rising Exports and Remittances

- - Rice Exports by Country

- - Vietnam beats us in RMG for last 5 months in 2019

- - VIETNAM COFFEE EXPORTS UNDER THE TOP 2 OF THE WORLD

- - Agri-food and horticulture in Vietnam

Copyrights Thiet Ke Website by ungdungviet.vn