-

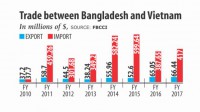

Bangladesh targets $1b trade ties with Vietnam

-

VIETNAM COFFEE EXPORTS UNDER THE TOP 2 OF THE WORLD

-

Rice Exports by Country

-

Relations between Bangladesh and Vietnam

-

Bangladesh Economic Outlook 2019: A resilient economy in need of sound policy LIGHTCASTLE ANALYTICS WING

-

Bangladesh Economy Continues Robust Growth with Rising Exports and Remittances

-

Vietnam beats us in RMG for last 5 months in 2019

-

Bangladesh to seek more Vietnamese investment

The different set up procedures for companies that want to begin

operations in the country. We also recommend professional assistance to guide companies

through the myriad of laws and procedures in the country.

Step 1 – Pre-investment approval

For some types of investment, companies need to seek the approval of Vietnamese authorities

prior to starting establishment procedures. As a result, it is important to understand if an

investment will require approval, and if so, preparing requisite documentation and working

against the application processing times.

Step 2 – Investment registration certificate application

The first step in the Vietnamese corporate establishment process is an application for an

Investment Registration Certificate (IRC). This is required of all 100 percent foreign owned

investment projects and establishes the right of the foreign enterprise to invest within Vietnam.

To apply an investor must:

• Application for implementation of investment project (this should include details of the

project in Vietnam);

• Proposal of investment project (should include the details of the investment project, including

lease agreements or land use needs); and

• Financial statements (to be provided for the last two years of a company’s operation; additional

information may be required to prove financial capacity).

Timeframe: 15 days from the date when documents are submitted.

Step 3 – Enterprise registration certificate application

The Enterprise Registration Certificate (ERC) is required for all projects that seek to set up new

entities within Vietnam. When obtained, the ERC will be accompanied by a number that will

double as the tax registration number of the entity.

As part of the application process, the following information should be prepared:

• Application for enterprise registration;

• Company charter;

AN INTRODUCTION TO DOING BUSINESS IN VIETNAM 2021 20

• List of all board members;

• List of legal representatives; and

• Letters of appointment and authorization.

Any foreign documents or supporting information provided will need to be notarized, legalized

by consular officials, and translated into Vietnamese by competent authorities.

Timeframe: Three days from the date when documents are submitted. It should be noted that

applications for the ERC and IRC can be processed concurrently; both can be obtained within

15 days when applied concurrently.

Step 4 – Post licensing procedures

Once the IRC and ERC have been issued, additional steps have to be taken to complete the

procedure and start business operations. This includes:

• Seal carving;

• Bank account opening;

• Labor registration;

• Business license tax payment;

• Charter capital contribution; and

• Public announcement of company establishment.

Charter capital

Charter capital can be used as working capital to operate the company. It can be combined

with loan capital or constitute 100 percent of the total investment capital of the company.

Both charter capital and the total investment capital (which also includes shareholders’ loans

or third-party finance), along with the company charter, must be registered with the license

issuing authority of Vietnam.

Investors cannot increase or decrease the charter capital amount without prior approval from

the local licensing authority.

Capital contribution schedules are set out in foreign-invested enterprise (FIE) charters (articles

of association), joint venture contracts and/or business cooperation contracts, in addition to

the FIE’s investment certificate.

Members and owners of a limited liability company (LLC) must contribute charter capital within

the capital contribution schedules set out in these documents and within the contribution

timeframes established by the Law on Enterprises.

To transfer capital into Vietnam, after setting up the FIE, foreign investors must open a capital bank

account in a legally licensed bank. A capital bank account is a special purpose foreign currency

account designed to enable tracking of the movement of capital flows in and out of the country.

The account also allows money to be transferred to current accounts in order to make incountry payments and other current transactions

Copyrights Thiet Ke Website by ungdungviet.vn